Welcome to Grupo Spurrier

Grupo Spurrier is the leading company in the provision of strategic information on economic and political issues regarding Ecuador, which we monitor through Weekly Analysis and Análisis Semanal. We specialize in economic research, competition advice, market research, business plans, and workshops in economic scenarios and regulatory changes.

Weekly Analysis Briefs

WA-2026-05: DEBT CONTINUES TO FALL

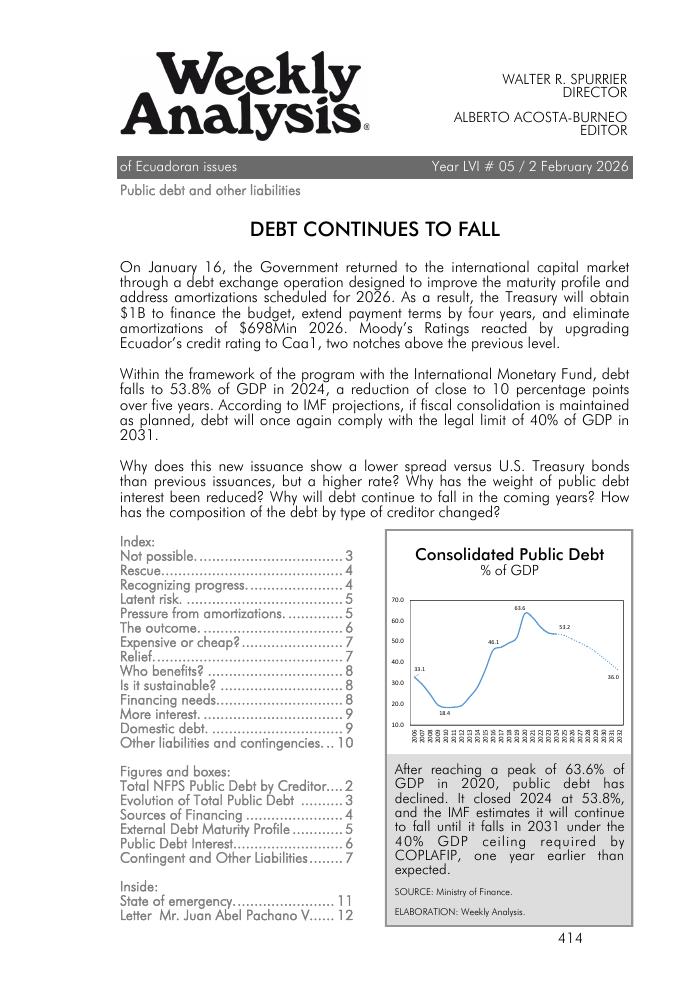

On January 16, the Government returned to the international capital market through a debt exchange operation designed to improve the maturity profile and address amortizations scheduled for 2026. As a result, the Treasury will obtain $1B to finance the budget, extend payment terms by four years, and eliminate amortizations of $698Min 2026. Moody’s Ratings reacted by upgrading Ecuador’s credit rating to Caa1, two notches above the previous level. Within the framework of the program with the International Monetary Fund, debt falls to 53.8% of GDP in 2024, a reduction of close to 10 percentage points over five years. According to IMF projections, if fiscal consolidation is maintained as planned, debt will once again comply with the legal limit of 40% of GDP in 2031. Why does this new issuance show a lower spread versus U.S. Treasury bonds than previous issuances, but a higher rate? Why has the weight of public debt interest been reduced? Why will debt continue to fall in the coming years? How has the composition of the debt by type of creditor changed?

WA-2026-04: TARIFF SKIRMISH

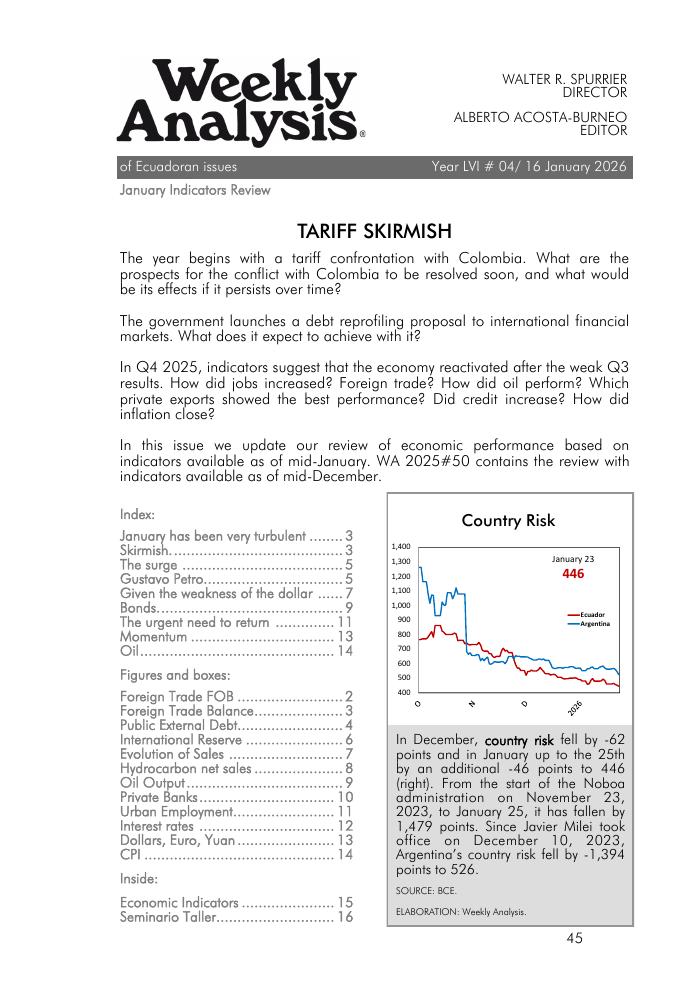

The year begins with a tariff confrontation with Colombia. What are the prospects for the conflict with Colombia to be resolved soon, and what would be its effects if it persists over time? The government launches a debt reprofiling proposal to international financial markets. What does it expect to achieve with it? In Q4 2025, indicators suggest that the economy reactivated after the weak Q3 results. How did jobs increased? Foreign trade? How did oil perform? Which private exports showed the best performance? Did credit increase? How did inflation close? In this issue we update our review of economic performance based on indicators available as of mid-January. WA 2025#50 contains the review with indicators available as of mid-December.

WA-2026-03: PRIVATE INVESTMENT… BARELY TOLERATED

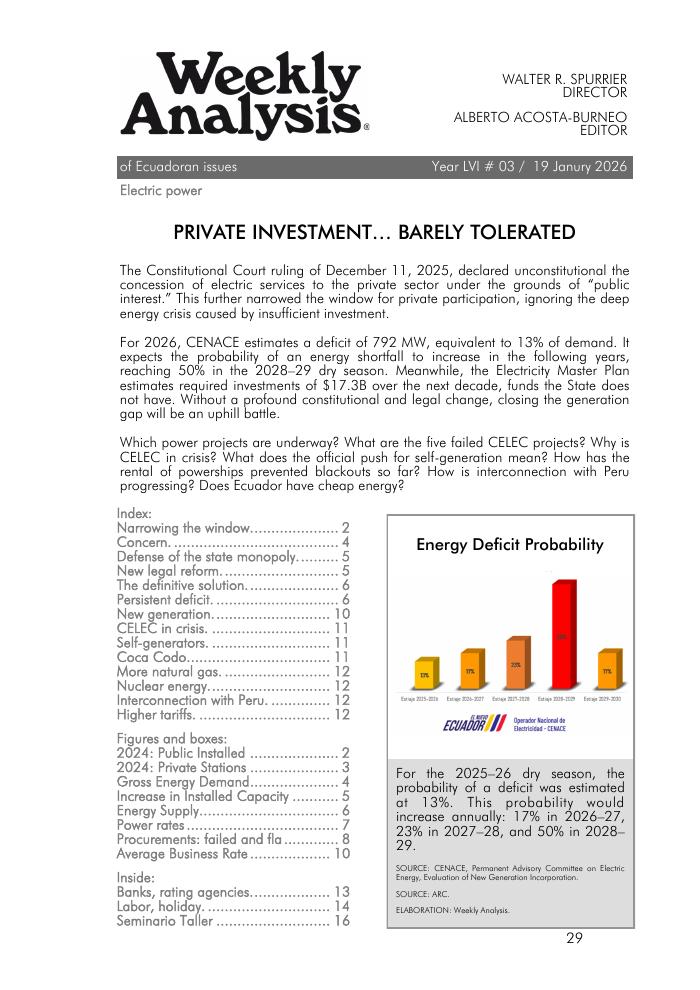

The Constitutional Court ruling of December 11, 2025, declared unconstitutional the concession of electric services to the private sector under the grounds of “public interest.” This further narrowed the window for private participation, ignoring the deep energy crisis caused by insufficient investment. For 2026, CENACE estimates a deficit of 792 MW, equivalent to 13% of demand. It expects the probability of an energy shortfall to increase in the following years, reaching 50% in the 2028–29 dry season. Meanwhile, the Electricity Master Plan estimates required investments of $17.3B over the next decade, funds the State does not have. Without a profound constitutional and legal change, closing the generation gap will be an uphill battle. Which power projects are underway? What are the five failed CELEC projects? Why is CELEC in crisis? What does the official push for self-generation mean? How has the rental of powerships prevented blackouts so far? How is interconnection with Peru progressing? Does Ecuador have cheap energy?

WA-2026-02: 294K MORE JOBS

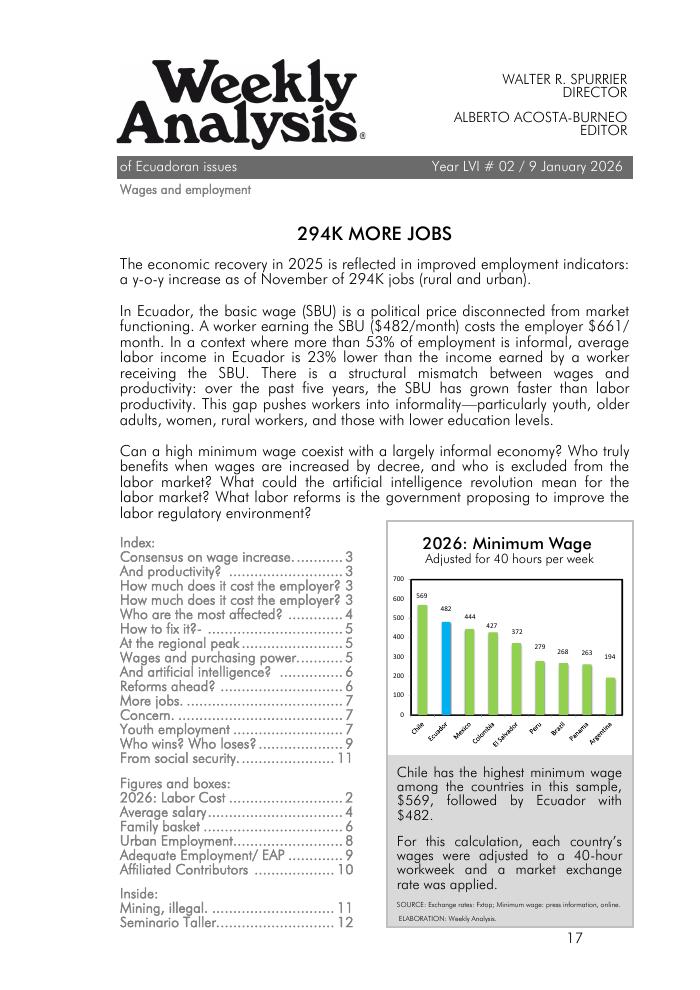

The economic recovery in 2025 is reflected in improved employment indicators: a y-o-y increase as of November of 294K jobs (rural and urban). In Ecuador, the basic wage (SBU) is a political price disconnected from market functioning. A worker earning the SBU ($482/month) costs the employer $661/month. In a context where more than 53% of employment is informal, average labor income in Ecuador is 23% lower than the income earned by a worker receiving the SBU. There is a structural mismatch between wages and productivity: over the past five years, the SBU has grown faster than labor productivity. This gap pushes workers into informality—particularly youth, older adults, women, rural workers, and those with lower education levels. Can a high minimum wage coexist with a largely informal economy? Who truly benefits when wages are increased by decree, and who is excluded from the labor market? What could the artificial intelligence revolution mean for the labor market? What labor reforms is the government proposing to improve the labor regulatory environment?

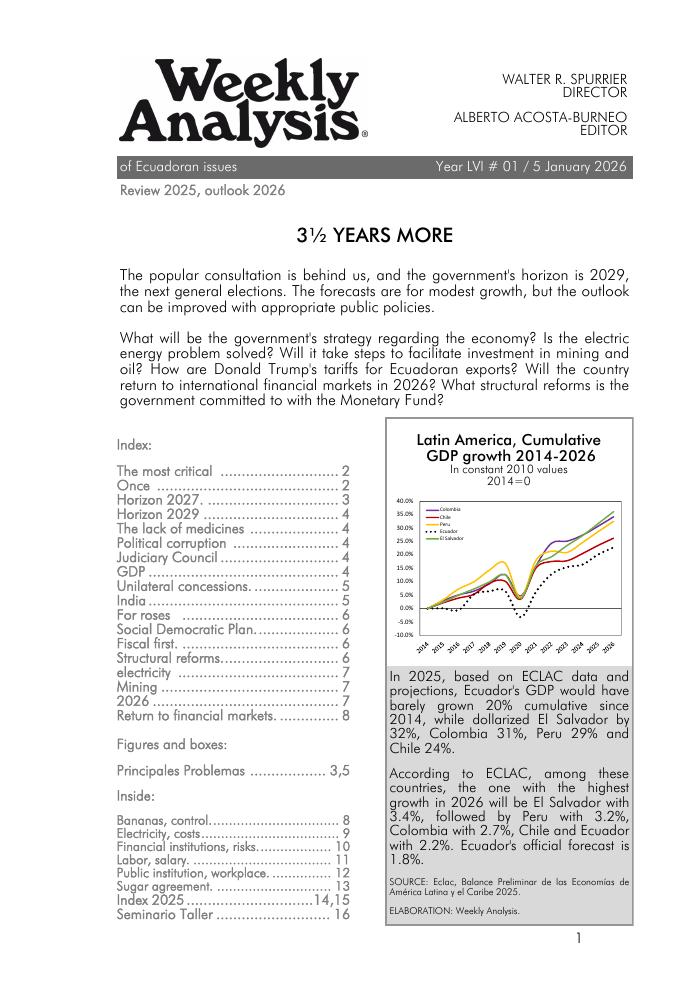

WA-2026-01: 3½ YEARS MORE

The popular consultation is behind us, and the government's horizon is 2029, the next general elections. The forecasts are for modest growth, but the outlook can be improved with appropriate public policies. What will be the government's strategy regarding the economy? Is the electric energy problem solved? Will it take steps to facilitate investment in mining and oil? How are Donald Trump's tariffs for Ecuadoran exports? Will the country return to international financial markets in 2026? What structural reforms is the government committed to with the Monetary Fund?

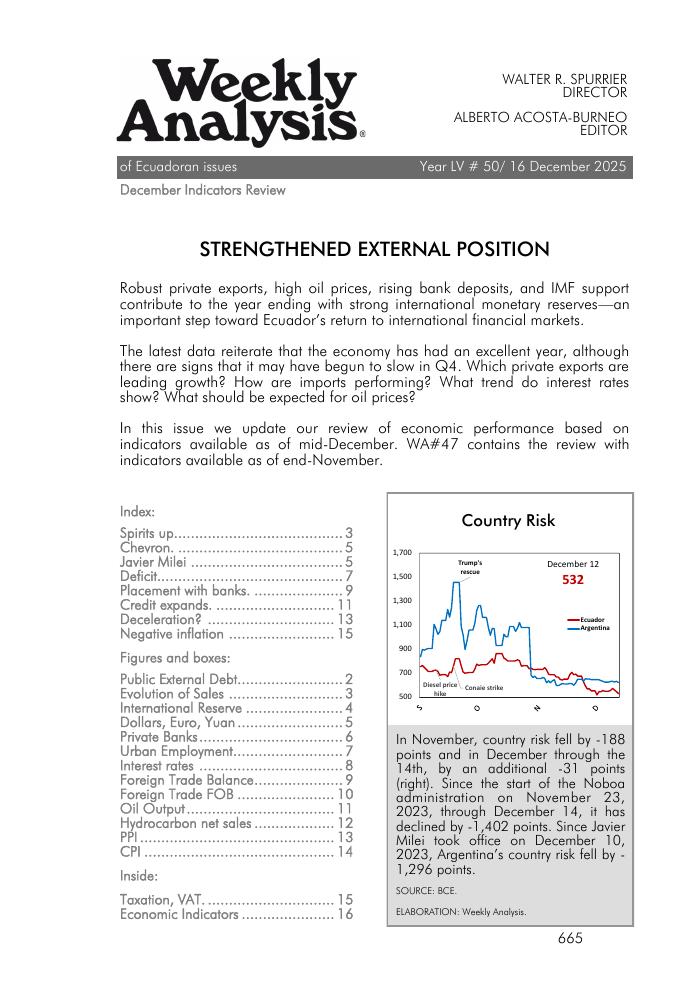

WA-2025-50: STRENGTHENED EXTERNAL POSITION

Robust private exports, high oil prices, rising bank deposits, and IMF support contribute to the year ending with strong international monetary reserves—an important step toward Ecuador’s return to international financial markets. The latest data reiterate that the economy has had an excellent year, although there are signs that it may have begun to slow in Q4. Which private exports are leading growth? How are imports performing? What trend do interest rates show? What should be expected for oil prices? In this issue we update our review of economic performance based on indicators available as of mid-December. WA#47 contains the review with indicators available as of end-November.